Financial Education: The Ultimate Money Guide to Living Financially Free

Driving down the highway, with the rooftop down, wind in my hair, on a beautiful sunny day on my way to the airport. My destination is Bora Bora, an exotic island surrounded by crystal blue water. That’s how I imagine financial freedom.

The best part? It’s a Monday. I don’t have to worry about work for the next week and I have everything on autopilot. Wouldn’t that be swell?

The purpose of this page is to provide you the ultimate money guide to living financially free. I created this guide because I wish I had something like this when I first started out.

This guide will provide you with:

- Confidence and the proper mindset of the wealthy

- The 2 most powerful tools to attaining financial freedom

- Calculating your financial freedom monthly target

- 6 Ways to make your money work for YOU

- My personal list of finance books that changed my life

This guide is meant to be a reference that will be updated regularly to help you on your journey to financial freedom.

Make sure to bookmark it!

What is financial freedom?

You keep hearing about this term financial freedom, but no one actually explained it in a way I understand. That’s where I come in.

Financial freedom is having enough money, usually from passive sources, to live the lifestyle you want, without having to work ever again, if that’s what you want.

Financial freedom means you can retire early. It allows you to go on vacations more than just once a year. Free from the worry of paying bills and whether you have enough money saved for a rainy day.

Even as I paint that scenario we have to recognize that financial freedom is different for everyone. Before we can set a realistic goal – which we will talk about later – to attain financial freedom, we have to consider how much money equals financial freedom.

Financial freedom is calculated by a certain dollar amount per month that will allow you to achieve the freedom you want. This is called targeted monthly income (TMI).

Is having a $5,000 per month of passive income enough for you to retire happily? Or do you need $8,000 per month?

Ultimately, financial freedom is being free from the trappings of a life revolving solely around money.

But, before we can achieve financial freedom we have to be financially educated.

What is financial education?

Financial education is the study of money, how to use it productively to attain wealth by making your money work for you versus working for it. By making your money work for you, you create time freedom.

An important factor in our financial education journey is our mindset.

During my formative years of formal education, I was never taught the basics of money.

Through my entire formal education career up until I graduated from college I was never taught:

- How the wealthy take advantage of tax benefits

- The importance of having an emergency fund

- Investing: how to make money work for you

- Living below your means, and investing the extra money

- How to create passive income sources

- The power of compound interest, and how to leverage time

- How to be wealthy

The sad reality was that I was wholly unprepared for the real world. I was just told to find a stable job, save money, and buy a house. That was about it.

No one taught me the secrets of the wealthy.

Related article: Lies We Tell Ourselves About Money. This article will expose the lies that we tell ourselves that prevents us from financial freedom.

What is time freedom?

One of the biggest benefit of financial freedom is time freedom. Time freedom is the new currency of the wealthy.

Do you find yourself saying, ‘I’m too busy?’ Do you wear it like a mark of success? I say there’s a better way.

The ultimate goal is to work on things that I love. Something that I do because I find meaning and joy from is a calling. And if money comes along with that, then that’s even better.

Time freedom allows you to:

- Take vacations not just 1 to 2 times a year, but whenever you want

- Work because you want to versus you have to

- Do all the things you wanted to, but can’t because you have a “real” job

- Escape the 9 to 5, dreaded commutes, and answering to less than caring bosses

- Pursue your own dreams instead of building someone else’s

- Spending more time with friends and family

- Start truly living and not just saying, thank god it’s Friday

There’s a better way to live, and it’s through financial freedom.

How to Achieve Financial Freedom

The simplest way that many of us will achieve financial freedom is by living below our means, saving the extra money from our W-2 job, and then investing it.

It looks like this:

- Save 20-30% of your paycheck AFTER taxes each month (40% for faster results)

- Take that money and invest it into a mutual fund that mirrors the SP500, I recommend using Vanguard, they have the lowest fees

- Don’t touch the money until at least 20 to 30 years down the road (this is to take advantage of compound interest and leveraging the power of time)

Faster approach. Do all the above AND:

- Build multiple streams of passive income (Rental properties, affiliate marketing, selling E-products)

- Repeat steps 2 and 3

Note: In order to make them “passive”, work upfront will be required, your systems or lack thereof will determine how successful you are.

“If you will live like no one else, later you can live like no one else.”― Dave Ramsey

What is compound interest?

I place a lot of emphasis on the advantages of compound interest.

As Albert Einstein wisely said, “the power of compound interest is the most powerful force in the universe.” And that’s coming from a guy who developed the theory of general relativity.

Compound interest is earning interest on your interest. For example, when you invest in the stock market, you’re buying a piece of the company hoping that it will give you a return on investment (ROI), which is a certain percentage of what you bought it at (purchase price).

The interest that you receive when a company does well, will be displayed by the increase in the price of the stock. And as time goes by, the interest you earn from the increase in the price of the stock will slowly compound.

Think of it as a snowball rolling downhill, and as it goes down the hill, it picks up speed, and momentum.

That is how compound interest works. Except in the case of stocks, it’s not gravity doing the trick, it’s time.

Bonus tip: to increase the power of compounding, take the interest you earn and reinvest it into the stock market. This is a tactic called DRIP.

I’m sure you’re now seeing a trend. I talk about time a lot. And it’s one of the biggest hacks, tips, tricks, call it what you want, that the wealthy are tuned in on. So let’s take a look at what the fuss is all about.

Leveraging time

The earlier headstart you have, the better. By saving up money and investing in the stock market early, you take advantage of time. It is more important how long you are in the market versus when you enter the market.

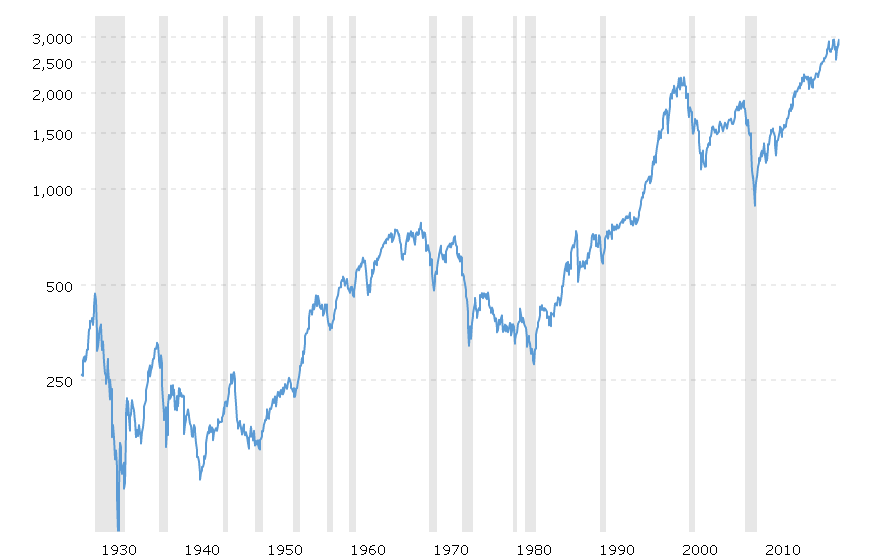

That is because on average the SP500 over the last 30 years has averaged an annual return of approximately 9.8%. So it is beneficial for you to get in the market early.

As you make more money throughout your career, you keep an eye on the market and spot any good opportunity to buy low.

Examples of buying low would be during the dotcom bubble burst in 2000, or the shockwaves of September 11, 2001 or during Great Recession of 2008.

These are anomalies in the market and usually don’t happen very often, but are an opportunity to buy stocks at a big discount. Other smaller opportunities will also arise, but you have to stay on top of the news and industry.

And if you’re not experienced or don’t care enough to look at the financial statements, annual reports, and the headlines, there’s nothing wrong with choosing an index fund that mirrors the SP500.

Whatever, you do, make sure to leverage time. And this goes without saying. Do your due diligence.

Note: I am not a financial advisor or pretend to be one. These are my opinions and my own experiences.

How to Calculate your Target Monthly Income (TMI)

First, you will need to calculate how much monthly income you need to live your ideal lifestyle. Owning a $4000/month mortgage and a $900/month car payment is vastly different from being mortgage free and owning your car outright.

Take some time to calculate an ideal and realistic goal. Make sure to include all your expenses you can think of.

How much will you be eating out, taking vacations, taking cruises, and feeding your crazy coffee habit?

A high quality of life will require a high TMI.

My personal TMI is $5400/month. If I create $5,400/month in passive income, then I can retire happily.

Once you have a TMI target in mind, then you can work backwards and start thinking of ways that you can create that passive income.

Let’s say I make $2,400/month of passive income from 2 rental properties. Now, I need another $3,000/month in passive income to be financially free. I can get those sources of income in many different ways.

The sooner you calculate your TMI, the sooner you have a actual number in mind. That means you don’t have to retire at 65, you can retire at 45, as long as you hit your target.

6 Ways To Make Money Work For You

The great thing is that money doesn’t sleep. It can pull an all nighter, and work on weekends. It doesn’t get tired.

6 examples of money working for you is:

- Rental Properties. A timeless and proven method to acquiring wealth. Not only does real estate provide you a physical asset, but it provides a source of rental income, equity, and tax benefits. And it can be as passive as you want.

- Purchase Stocks. Buying a piece of a company that already has a great management team, proven profitability, and long term growth potential while receiving both dividends and appreciation of price. It doesn’t get any better than that.

- Create an Online Course. Spend the time upfront creating an course that is high quality and hands off by setting up a system that doesn’t require much upkeep.

- Credit Card rewards. As an avid travel enthusiast I don’t know what I would do without credit card rewards. From saving thousands of dollars on flights, enjoying first class meals at some of the best lounges in the world, I can say this is definitely an investment that pays for itself.

- Start a side hustle. Doing something you’re passionate about and making money from it is the best feeling in the world. Even if you don’t start out making money, and you probably won’t, it’s still great if you can help others and make an impact. Not everything is about money.

- Build your personal brand. In today’s day and age, your personal brand is more and more important. Start early and develop your presence online and within your community. Reap the rewards down the road.

Each of these methods require work upfront, but the rewards can be limitless. While there’s nothing wrong with a 9 to 5 job, it limits your earning potential. You get a paid wage or salary, and usually the only way to earn more is to work more.

You’re trading time for money and time is priceless, you do the math.

Try just 1 of the 6 proven methods above. Slowly build your knowledge in the topic and start executing. Being financially free isn’t as hard as it seems. It does require a healthy dose of patience and action.

Mindset of the wealthy

I would be remiss if you made it this far and I didn’t tell you that perhaps the most important part of your financial education will be your mindset.

There’s this common misconception that the rich and wealthy got lucky. Somehow they managed to hit it big or had rich parents. Surprising to most, a study conducted by Fidelity Investments found that 88% of millionaires are self-made.

A great book that I love is the Millionaire Next Door. It exposes the truth about millionaires and the traits that got them there.

The wealthy didn’t just happenchance upon a bucket of gold at the end of the rainbow. They learned the secrets to living financially free, by being financially educated. It wasn’t an accident, it was a choice.

Bonus tip: spend as much time honing your mindset, as you do on your financial education.

The wealthy think differently. Their minds are trained towards building systems, making money work for them, and thinking long term.

On your journey to living financially free, remember that how you think, is just as important as what you know.

Finance Books for beginners

The smartest investment you can make, will always be yourself.

I use to not buy the books because I didn’t want to spend the money, but a wise friend called me out. He said, “if you’re willing to spend $1,000 a year on coffee, but you won’t buy a book for $12, that can possibly transform your life, then you need to really think what’s important to you.”

A big part of our financial education will be taking the nuggets of wisdom from people who have done what we want to achieve. And that’s where books come into play.

Here is my list of my all time favorite money books that you should at least read once. If you can’t afford to buy the book, head to the public library. Whatever you do, make sure you invest in yourself.

Rich Dad Poor Dad by Robert Kiyosaki

A powerful story of 2 dads, one rich and one poor. How one young man learned the secrets to financial freedom and what it takes to be wealthy. It is an easy read, but filled with nuggets of wisdom. It won’t provide you with a clear cut path for financial freedom, but points you in the right direction.

The Richest Man in Babylon by George S. Clason

A timeless classic written in such a compelling way that teaches invaluable lessons of building wealth. The author uses simple stories of merchants, tradesman, and herdsman of Ancient Babylon to illustrate important lessons. This is a great book for any age, but especially so for the young. A book I would pass along to my children.

The Intelligent Investor by Benjamin Graham

Often cited as the bible of the stock markets, this timeless classic was published in 1949. The principles in this book have influenced great investors such as Warren Buffett, William Ackerman, John Bogle. Graham’s philosophy of value investing teaches long term strategies that can lead to substantial wealth.

The Millionaire Next Door by Thomas Stanley & William Danko

An insightful book that dives into the habits and mindset of the “millionaire next door”. Learn the habits of millionaires and who they actually are. The book is littered with statistics, charts and graph of actual millionaires and the traits that got them there. A book I highly recommend.

Cashflow Quadrant by Robert Kiyosaki

A book that highlights the real reasons there’s such a huge disparity between the haves and have nots. Kiyosaki thoroughly explains why you don’t want to be on the E (employee) and S (self-employed) side of the quadrant and how to be on the B (business owner) and I (investor) side of the quadrant. The concepts of this book is easy to understand and will blow your mind.

Think and Grow Rich by Napoleon Hill

A book originally published in 1937 is still held in high esteem to this day. The timeless principles taught in this book draws on the stories of greats like Andrew Carnegie, Thomas Edison, and Henry Ford. This is the type of book that you will highlight, bookmark, and re-read over and over again.

ABCs of Real Estate Investing by Ken McElroy

This book teaches you the basic, but proven steps needed to get into the real estate investing. Real estate investing is a timeless and proven way to build wealth. Don’t let the lack of knowledge stop you. This book will give you the knowledge and the confidence to do your first, second, and fiftieth deal.

Conclusion

As I’m on the same journey that many of you are on, I will be continually refining and adding what I learn here. So many sure you save and bookmark this page.

I hope you found value in this money guide. It is everything that I wish someone taught me when I was growing up. If had known half the things on here than I would be way further on my journey towards living financially free.

As always, thanks for reading!