Why Now is The Best Time to Invest

By Warren Wong

Money can be a touchy subject, let alone how to invest. But it doesn’t have to be. Money is one of the most important subject that is neglected from everyday conversation.

This has led to a disproportionate distribution of knowledge amongst the people who know and don’t know, the haves and have nots, the rich and the poor.

Reality of The American Dream

Growing up as first generation Americans of immigrant parents my brother and I faced our own set financial hardships.

Both our parents immigrated here from China. They gave up everything for the “American Dream”.

They left behind their friends, family, job, and culture.

Moving to the U.S., without a lick of English, my father worked as a handyman: plumbing, construction, painting, moving and odd jobs to put food on the table. He still continues working to this day, albeit a lot less. He is 65 this year.

Everyday my dad would get up at 5AM to get ready for work and start up the beat up white van and drive all across New York for work.

His life had two profound effects on me.

#1: Financial freedom through investing

Here’s what I learned:

The power of the compound effect.

It is one of the most powerful forces in the universe. It is simply everyday small choices that over time leads to exponential growth.

Think of it this way.

QUESTION: If you were given the choice between $3 million cash upfront today or choose a penny that doubles in value every day for 31 days, which would you choose?

If you chose the penny, you would be in the minority.

Looking at the math, in the first 3 weeks, your penny would amount to about $5,000, not a whole lot. But, by day 31, you would have approximately $11 million, roughly 4 times the amount of the $3 million paid up front.

This is the secret to the wealthy. They are able to delay instant gratification for long term wealth.

What does this mean for you and I?

It’s not like someone is going to offer us $3 million to invest. It means that your everyday choices right now will have a profound effect on your future self. This is the secret to the super successful and the wealthy.

It all starts with financial freedom.

What is financial freedom?

Well, I’m glad you asked. Financial freedom is different for everyone. Some can live off of $50,000 a year and some people can’t survive even on $110,000 a year. Financial freedom is relative and only you can determine what works for you for the lifestyle you want to live.

Here’s some food for thought. Financial freedom can be, not ever having to worry about paying your bills on time, not having to live paycheck to paycheck. Not having to work a dead end job that you hate.

In addition, you can take a job that pays less, but it’s something you are passionate about. It means you are free to pursue your dreams and goals with no worry of “what if”.

Although money is not a factor for happiness, it is a powerful tool to achieve happiness. I’ll let that sink in; pause for effect.

Now, you’re probably like OK, Warren, tell me how to do it then.

# 2: Invest Now

I started to invest when I was 23. After reading “Rich Dad Poor Dad” by Robert T. Kiyosaki, my whole mindset shifted. If you want to jump start your life, read this book.

Without going down a rabbit hole, it painted the picture of how I wanted to live my life; beholden to no one, captain of my ship. If this sounds like something you want, then keep reading.

I’m a big believer in long term passive investing. The set it and forget it method.

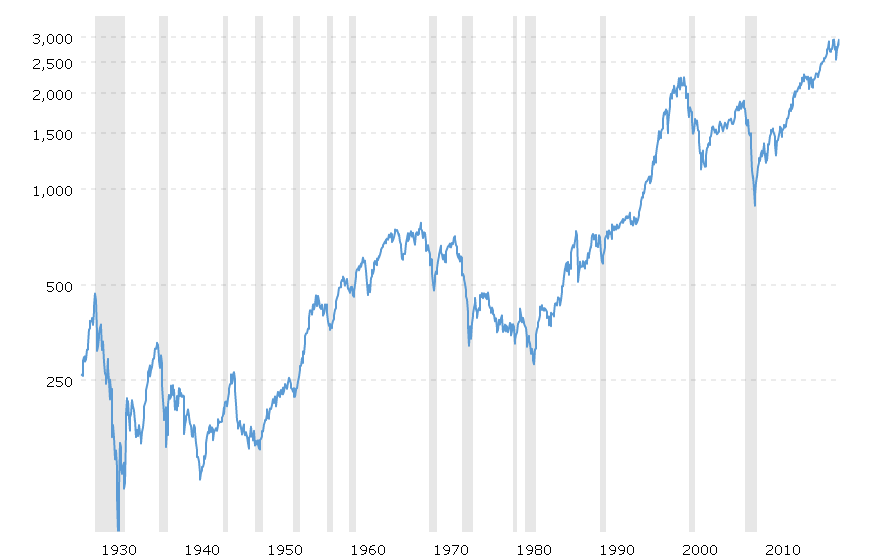

Historically, the S&P 500 (500 largest publicly traded companies) over the past 90 years has averaged an annual return of approximately 9%.

If you are playing the long game, especially when you are young and more risk tolerant, you can make a substantial return on investment (ROI).

This means the money you invest now, you are not touching it until 20, 30, 40 years down the road.

This is taking into account the power of the compound effect, through both the price increase of the stock (appreciation), and the ability for the company to pay dividends (distribution of profits).

Meanwhile, the dividends are being automatically reinvested. This strategy will increase the compounding effect.

How and where do I invest?

Personally, I invest in index funds (stocks that mirror the S&P 500) using Vanguard and also Charles Schwab. They have some of the lowest fees and best performing indexes.

Normally, any income that isn’t going to my normal monthly expenses of rent, gas, grocery, phone/internet bill, I invest in mutual funds that mirror the market.

Conclusion

In summary, save money and start investing now. Take advantage of what the wealthy already know, the compound effect.

Financial freedom is possible.

Hopefully, I’ve given you something to chew on and got you thinking.

I can’t say that enough. If I knew what I knew 5 years ago, I would have started then. Every month and year counts. Every dollar counts.

Question for you

Was financial education a part of your household growing up and what do you wish you knew sooner?

P.S. My parents are a huge source of inspiration. Their actions and how they raised my brother and I speaks volumes in itself. I can’t help but make sure that they don’t have to worry about their son. I’m OK mom. I’m OK dad.

***

Note: I am not a financial planner or hold any formal licenses. These are my ideas and opinions. Do your own due diligence before conducting any type of investing.